Insurance Solutions

We support insurers, reinsurers, and public schemes with EO, AI, and data integration—built for trust, speed, and transparency. From drought detection to post-disaster validation, we deliver the tools insurers need to protect clients and scale coverage.

In a world of increasing climate volatility, traditional insurance models are struggling to keep up. Droughts, floods, and crop failures are hitting harder and affecting communities that often lack fast or fair access to financial relief. That’s where data-driven insurance steps in. At SPACE-SHIP, we help insurers, agri-finance providers, and governments design and deploy Earth Observation–powered insurance systems. Our solutions use satellite data, weather records, and AI to detect stress, trigger payouts, and validate claims—quickly, transparently, and at scale.

$14.6B

11%

40%

We bring deep technical and domain expertise to support index-based and climate risk insurance solutions. Our team combines Earth Observation, AI, and actuarial understanding to develop reliable, scalable tools for drought detection, flood monitoring, and damage assessment. With experience across agriculture, disaster risk, and financial modelling, we help insurers, reinsurers, and public schemes deliver faster payouts, reduce fraud, and expand coverage where it’s needed most.

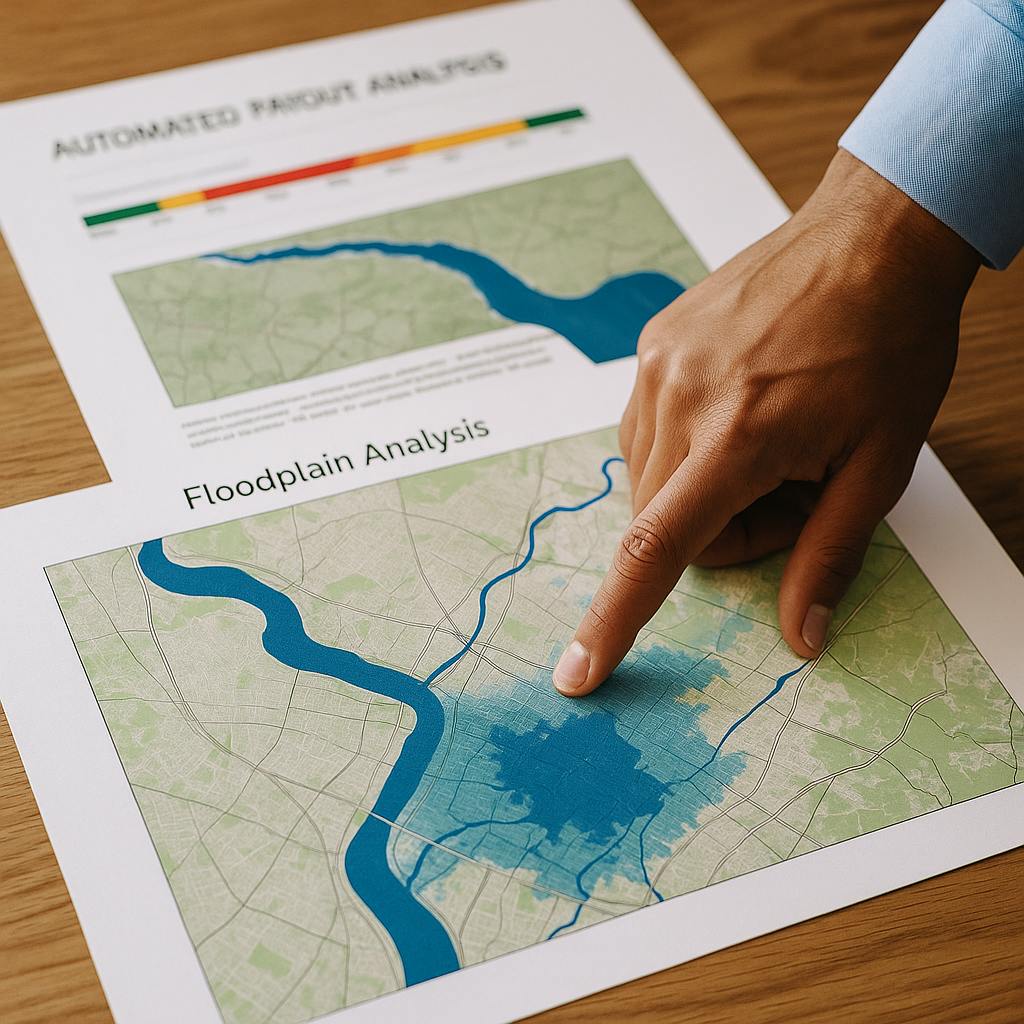

We work with insurance and financial service providers to build custom pipelines for index-based insurance and remote claims assessment. By fusing EO data with AI-driven analysis, we enable fully automated, scalable coverage models that lower cost and increase accessibility.

Anomaly Detection for Drought, Flood, and Crop Stress

Time-series analysis of NDVI, rainfall, and temperature to detect weather-related anomalies and trigger payout events.

Claim Validation & Impact Mapping

Post-event EO assessments that confirm affected areas and support fast-track processing—minimising dispute and field inspection costs.

Automated Payout Trigger Design

Custom thresholds and insurance logic (e.g. rainfall deviation, NDVI drop) configured per region, crop, or client requirement.

EO-Integrated Risk Monitoring Dashboards

Tools for insurers and underwriters to monitor portfolio exposure in real time, overlay policyholder data, and assess cumulative risk.

Sentinel-2, MODIS, CHIRPS, ERA5, NDVI/NDWI composites, SMAP, Google Earth Engine, Python, Scikit-learn, PostGIS, satellite-backed index frameworks (WII, drought models).